CeFiWire Most Read for August 18: Securitize Buys OnRamp. What Does it Mean?

What was news for the week ending August 18, 2023.

The wider crypto world saw a Bitcoin price flash crash last week. By the time the dust settled Bitcoin was priced around the same as it was when BlackRock filed for a spot Bitcoin ETP. That ETP is still nowhere near approval but Jacobi’s spot Bitcoin ETP is no trading in Europe. As long-time mutual fund specialists (we have published Mutual Fund Wire since 1999), we will again point out that Jacobi’s product is not a UCIT and is regulated out of Guernsey, not Brussels. To us that makes it an exchange-traded product and not a true ETF. We reserve the ETF term for UCITs and mutual funds registered under the 1940 Investment Company Act.

* * *

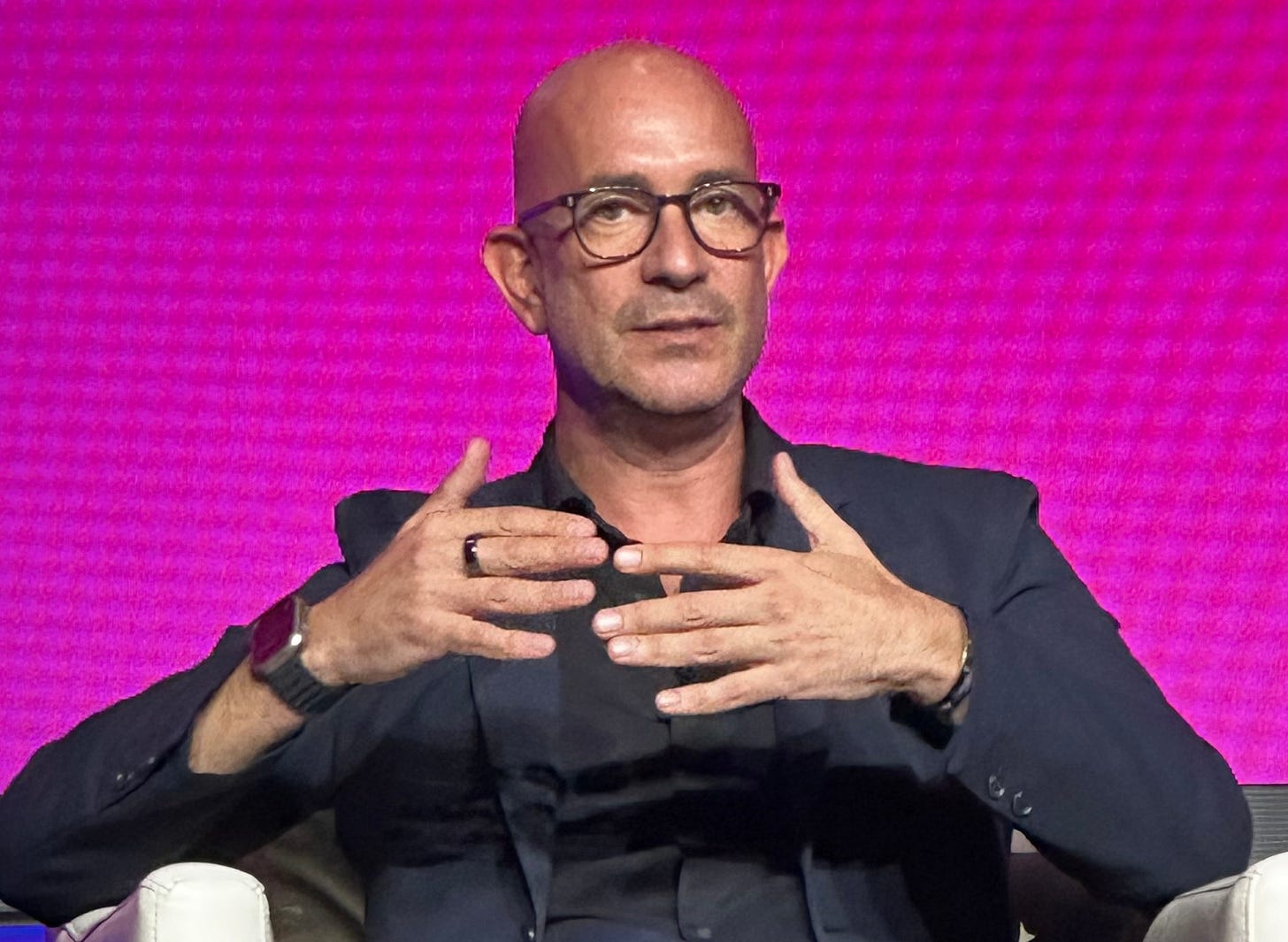

Eric Ervin’s sale of his second startup — Onramp Invest — to Carlos Domingo-led Securitize was the most interesting deal of the week. Ervin’s first startup was an Reality Shares, an ETF shop that focused on advisors for distribution.

The value of Onramp to Securitize seems open to question. The two firms already had agreements that put Securitize’s offerings in front of Onramp’s advisors and Ervin told CeFiWire that he expected to add new offerings as they become available. So, buying OnRamp is unlikely to create more distribution opportunities for Securitize than it would have had already.

On the plus side, Securitize will save any platform fees it was paying OnRamp. CeFiWire does not know what those were, but at this point that must have been negligible as there is essentially no use of these assets by advisors yet. OnRamp claims that it has RIAs that control $40 billion of assets on its platform. That is a rounding error in compared to the $3.6 trillion of advisor assets on Schwab’s platform alone. That number also doesn't reflect that advisors using OnRamp are unlikely to have a meaningful share of their assets invested in tokenized securities and that most of the advisors signed on with OnRamp to invest client assets in crypto.

On the minus side, the last three decades have shown that advisors like open platforms. If Securitize is not careful, other tokenizers may support other advisor distribution platforms as they emerge to avoid helping a rival and Onramp could find its growth inhibited.

One immediate benefit that the sale does bring Securitize is a sense of momentum. In a market where the business metrics are moving grindingly slowly, the deal shows Securitize making progress. That could help it with venture capital investors trying to identify market leaders and asset managers seeking to find a partner to tokenize their products.

Still, it is early days, so make of it what you will.

— Sean Hanna, Editor

The Most Read Five

1. Bitgo Raises $100 million in an Up Round

The digital assets custodian raises at a $1.75 billion valuation. (August 16)

2. Jacobi ETP Goes Live, Ark ETP Faces Delay

3. Carlos Makes a Deal

Connect to CeFiWire! JUST ONE LEAD PAYS FOR YOUR MEMBERSHIP

To access to our exclusives, simply send an email to Veronica@CeFiWire.com and we will provide a trial and enterprise pricing. Or call us at 646-450-3474. It’s that simple…

You Get …

✅ Unlimited members from your company for one price

✅ Daily exclusives and links to the info your team needs

✅ Invites to in-person meetings and conferences

👍 And, as a bonus you will help create an industry community and the benefits to everyone that come with it.

The Rest of the Week’s News

CeFiWire Resources

Conferences & Events

People are again traveling. Here are some of the upcoming events that are of interest.

Sponsor CeFiWire! Create Community

Every community needs its daily rag … make us yours.

We are seeking charter sponsors for CeFiWire’s launch. This is an opportunity to provide unique value to your clients and partners. Sponsors get …

✅ Memberships for industry players of their choosing.

✅ Branding in emails and on the Web site.

✅ Unique benefits negotiated directly with our ad sales team

Contact Sales@CeFiWire.com or call 646-450-3474 for more information.