The World Turned Upside Down

This week Novo and his team at Galaxy Financial partnered with Leshner's Superstate and changed TradeFi forever; Goone is gone and Newns has moved on to something new.

Yes, it takes some blood, sweat and tears, but you can now hold a common stock in your Solana wallet, no brokerage account needed. Until this week, the only tokenized “stocks” were really derivatives. Typically they were stakes in a special purpose vehicle (SPV) that held the stock you wanted to invest in. In some cases, the brokerage firm or sponsor was merely making an un-backed promise to match a stock’s return based just on its balance sheet credit. At best, they were a “digital twin” of a stock recordkept on a old-fashioned transfer agent’s database. In the off-the-record words of one TradFi expert, they are all sucky shortcuts.

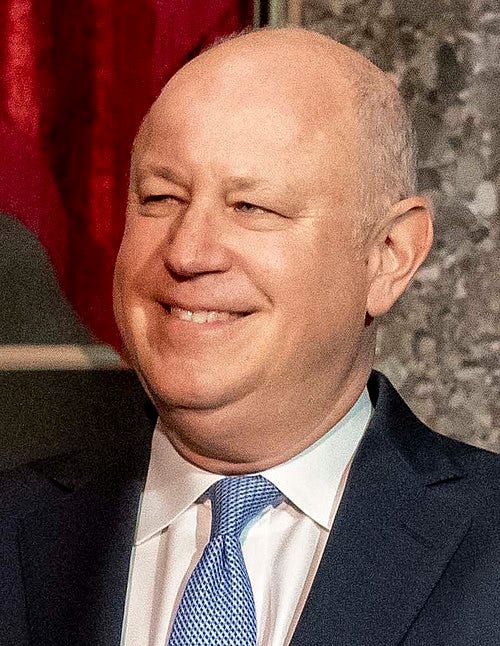

That has all changed thanks to Mike Novogratz and Superstate founder Robert Leshner. Novogratz, a one-time Princeton wrestler, Goldman salesman and “BSD” at Fortress, has long wanted to offer Galaxy’s shares both in the United States and as a token. This year, he has accomplished both goals. Last spring, Galaxy relisted its shares from Toronto to New York and last week it partnered with Leshner’s Superstate to offer shares recordkept on Solana as the primary record. Superstate is the SEC-approved transfer agent and has developed the blockchain-based system. The Galaxy shares are also part of Superstate’s Opening Bell platform.

As Galaxy points out in its white paper — if you are in TradFi, you had better read it — blockchain is really just a new way to keep records. Tokens, it turns out, are really just an entry in an elaborate spreadsheet.

Long ago, shareholders used sheets of paper with signatures to recordkeep their ownership. Then, when they tired of trekking along Manhattan’s streets to the Buttonwood Tree and cafes on Wall Street, share owners deputized agents to record the transfers of their stakes on the pages of ledger books. Many years later, the SEC made even the most reluctant of those transfer agents keep their records in computer databases. And so, the DTCC. Blockchains are the next logical step in that evolution.

Galaxy’s white paper astutely points out that blockchain recordkeeping now allows shareholders to custody their shares themselves in their own blockchain wallet. Thus, we are returning full circle to a world in which you can sell your shares to someone directly, no intermediary needed. Only you do not have to make a trip to a cafe.

As of yet, Galaxy’s shares are the only ones you can keep on your new Solana phone. And there is no compelling advantage to holding the shares in tokenized form. While Galaxy details a step-by-step process to convert shares through a DRS transfer to Equiniti from your brokerage account to tokens, the Galaxy white paper admits that there is no existing market to trade share tokens. Leshner and Novo do promise that they are working with the SEC to create AMMs for peer-to-peer trading, but there is no timeline on when that will happen.

Still, the future is here and CEOs had better be working on a strategy to survive and thrive. Especially if you are Jeffrey Sprecher.

Sprecher is the CEO of the Intercontinental Exchange (ICE), which owns both the London and New York stock exchanges. ICE, you could say, is the direct descendant of those coffee houses that evolved into what we have today. If tokenization takes us back to the past, Sprecher is going to have to have a plan. The question is whether he is aware. News this week suggest that he may be awake to the change.

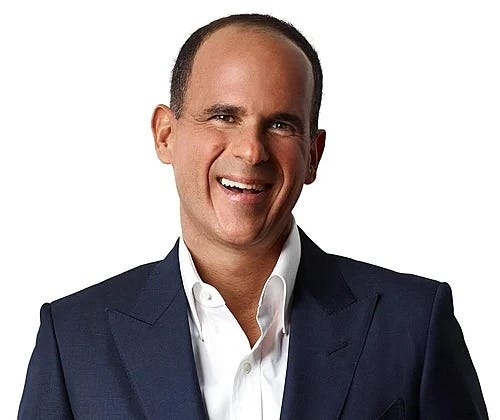

This past week Marcus Lemonis, the fixer who took over as CEO of Overstock (now Bed Bath and Beyond) last spring, sent a letter to the board of tZERO asking it to fire its CEO David Goone. Interestingly, Goone worked as ICE’s chief strategy officer prior to taking the top job at tZERO. Lemonis, who has a television show on Fox in which he advises small business owners on how to fix their operations, was upset that Goone ignored Lemonis’ earlier request a few weeks back to IPO tZERO. Lemonis, it turns out, desperately needs cash to open new Bed Bath & Beyond (BB&B) stores and as BB&B owns forty percent of tZERO, an IPO would meet his needs nicely. Lemonis is also working sans salary and needs BB&B shares quintuple in value to hit $45 for his first payday. Let’s say he appears to be motivated to make a deal.

Sprecher’s ICE is the other large stakeholder in tZERO. It also owns forty percent of the blockchain startup. While it ignored Lemonis’ first letter, this time the board listened. On Thursday, Goone was gone and tZERO’s board named Alan Konevsky the new CEO. Konevesy had been tZERO’s chief legal and corporate affairs officer and before that its interim CEO until 2022.

All of this likely means that tZERO must be “in play” and that Sprecher at ICE is going to have to make a decision soon. Lemonis is looking for a buyer of BB&B’s tZERO stake and ICE is the logical candidate. If stock markets are going on blockchain, buying the remainder of tZERO will signal ICE’s and Sprecher’s commitment to the future. The fact that tZERO has little substance in its business today — along with Prometheum it holds one of two existing special purpose broker-dealer licenses, has some blockchain technology but no meaningful revenue — is less important than Sprecher sending a message to his troops that the future is coming.

Buying the majority of tZERO’s shares could also head off competition. What form could that take? Well, Mike Cagney is prepping the IPO of his latest startup for this coming Thursday. His company — Figure Technology Solutions — is also working on natively tokenizing its stock through its Provenance blockchain. Cagney has also stated his ambition is to create the “Nasdaq” of the next century when he was making a play for the Celsius bankruptcy estate. Figure’s IPO will give him a war chest and currency to make deals of his own.

There is one final thread that unraveled in the past week that is worth pulling on: David Newns, the CEO of the SIX Group’s former SDX business stepped down. For those not in the know, SIX is the owner of the Zurich and Munich stock exchanges and spent the first half of this decade creating tokenized equities though its SIX Digital Exchange (SDX) arm. Under Newn’s leadership, SDX went live in 2024 and last spring, SIX absorbed SDX into its servicing business. Yes, it turns out that SIX, not Galaxy, was the first to natively tokenize shares of stock, but if it happened in Zug, no Americans notice.

What Newns is up to now is anyone’s guess.

Related Stories

Sponsor CeFiWire! Create Community

Every community needs its daily rag … make us yours.

We are seeking charter sponsors for CeFiWire’s launch. This is an opportunity to provide unique value to your clients and partners. Sponsors get …

✅ Memberships for industry players of their choosing.

✅ Branding in emails and on the Web site.

✅ Unique benefits negotiated directly with our ad sales team

Contact Veronica@CeFiWire.com or call 646-450-3474 for more information.